“As an Amazon Associate I earn from qualifying purchases.”

In these uncertain times, it has become more important than ever to prioritize our financial stability. The global recession caused by the COVID-19 pandemic has left many individuals and families feeling vulnerable and unsure about their financial future. However, there are strategies and resources available that can empower individuals to navigate through this challenging phase and secure their financial well-being.

One such resource gaining attention is Empower Financial Stability Recession Survival, a comprehensive program designed to provide the knowledge and tools needed to overcome the financial challenges of a recession. In this article, we will delve deeper into the features and benefits of Empower Financial Stability Recession Survival, exploring how it can help individuals and families build resilience, make informed financial decisions, and ultimately thrive during turbulent economic times.

Simple Steps to Financial Freedom is a great book to get you started on your path to financial freedom. It introduces a lot of key financial concepts and strategies in a way that is simple to understand and easy for anyone to apply to their own life.

- Easy to follow

- Useful worksheets and checklists

- Practical, actionable advice

- Quick and easy tips

- Written by a financial expert

- Lacks specific information on investing

- Some concepts are too simple, requiring more advanced knowledge

Author: Will Power

Rating: 4.6 out of 5

Steps: Simple

For: Financial Stability

Language: English

Size: 300 pages

What is Empower Financial Stability Recession Survival?

Empower Financial Stability Recession Survival is a concept that focuses on providing individuals and families with the tools and resources they need to navigate through economic downturns successfully. The term “empower” implies the idea of giving people the confidence and control over their financial situations, even in the face of a recession.

During times of economic uncertainty, it is crucial to have a plan in place to ensure financial stability. This plan may include developing a budget, reducing expenses, and increasing savings. Empower Financial Stability Recession Survival emphasizes the importance of building an emergency fund to cover unexpected expenses and providing financial education to encourage informed decision-making.

Furthermore, the concept recognizes that financial stability goes beyond merely surviving the recession. It also encompasses strategies to rebound and thrive once the economy begins to recover. This can involve reevaluating investments, exploring new income streams, or even pursuing additional education or training to enhance career prospects.

Overall, Empower Financial Stability Recession Survival is about taking control of one’s financial future, even in challenging economic times. By providing individuals with the knowledge and resources necessary to weather the storm, this approach aims to empower individuals and families to not only survive but also thrive in the face of a recession.

Empower Simple Steps to Financial Stability: A comprehensive guide

In today’s uncertain economic climate, achieving financial stability can feel like an elusive goal. But fear not, for with a few simple steps, you can empower yourself and take control of your finances. Whether you’re a recent graduate entering the workforce or someone looking to rebound from the effects of a recession, implementing these strategies will help you weather any storm.

Firstly, it’s essential to create a budget and stick to it religiously. Start by listing your sources of income and then allocate funds for your expenses, including necessities such as rent, utilities, and groceries. Be sure to set aside a portion for savings and emergencies. By tracking your spending closely, you can identify areas where you can cut back and save more effectively.

Secondly, aim to eliminate any high-interest debt as soon as possible. This includes credit card balances, personal loans, and student loans. Focus on paying off the highest interest rates first while making minimum payments on other debts. By doing so, you’ll save on interest fees and be well on your way to financial freedom.

Lastly, don’t underestimate the power of investing in yourself and acquiring new skills. In times of uncertainty, having a diverse skill set can make you more resilient in the job market. Consider taking online courses or attending workshops to enhance your knowledge and increase your value as an employee or entrepreneur. Investing in yourself today will lead to greater opportunities and stability in the long run.

In conclusion, while financial stability may seem daunting, it’s achievable through a series of small, intentional steps. By following a budget, paying off debt, and investing in yourself, you can empower your financial future. Remember, the key to success lies in your commitment to these principles and your ability to adapt to the ever-changing landscape. Take control of your finances today and thrive in any economic climate.

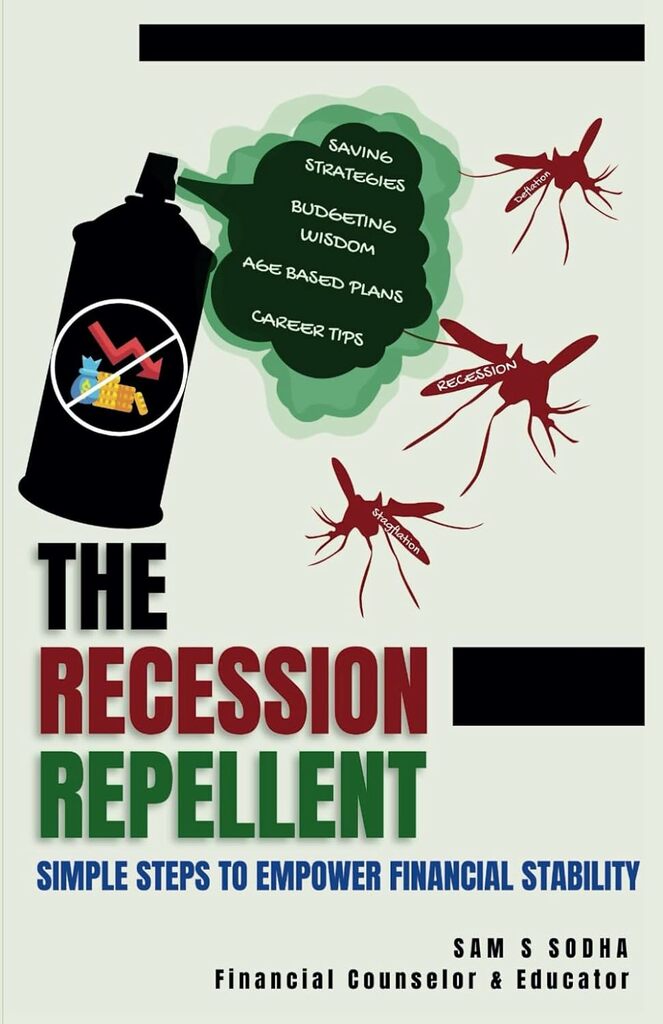

The Recession Repellent: Step by step instructions on how to implement the strategies

In these uncertain times, financial stability has become a priority for many individuals and families. With the looming threat of a recession, it is essential to have a solid plan in place to navigate through the financial challenges that may arise. Empowering yourself with the right strategies can be the key to recession survival.

The first step in implementing these strategies is to assess your current financial situation. Take a close look at your income, expenses, and savings. Identify areas where you can cut back and save more money. This may involve making some tough choices and prioritizing your needs over wants. By creating a budget and sticking to it, you can ensure that your expenses are in line with your income.

Next, focus on building an emergency fund. Set aside a portion of your income each month to create a safety net for unexpected expenses. It is recommended to have at least three to six months’ worth of living expenses saved up in case of a job loss or other financial emergencies. By having this cushion, you can avoid going into debt and reduce financial stress during a recession.

Additionally, it is crucial to diversify your income sources. Relying solely on a single job or source of income can be risky during a recession. Explore opportunities for additional income streams, whether it be through a side hustle, freelancing, or investing. By diversifying your income, you can better protect yourself from sudden financial setbacks.

Lastly, be proactive in managing your debts. Pay off high-interest debts as quickly as possible to minimize the impact of interest charges on your finances. Consider options such as debt consolidation or negotiating with creditors for better repayment terms. By taking control of your debts, you can minimize financial strain and empower yourself to weather the storm of a recession.

In conclusion, implementing these strategies can build your financial stability and equip you for recession survival. By assessing your financial situation, building an emergency fund, diversifying your income, and actively managing your debts, you can be better prepared to navigate any financial challenges that come your way. Remember, taking small steps today can have a profound impact on your future financial well-being.

Benefits of using the Recession Repellent

In today’s uncertain economic climate, finding ways to protect our finances and ensure stability is more important than ever. That’s where the Recession Repellent comes in. This innovative tool is designed to empower individuals and families to navigate through tough economic times with ease, providing a shield against the negative effects of recessions.

One of the key benefits of using the Recession Repellent is its ability to empower financial stability. By utilizing this tool, individuals can take control of their finances and make informed decisions to protect their wealth. The Recession Repellent provides valuable insights and strategies to weather the storm, giving users the confidence they need to thrive in uncertain times.

Another significant advantage of the Recession Repellent is its emphasis on recession survival. It equips users with practical tips and guidance on how to not only survive but thrive during economic downturns. From budgeting and saving to investing and diversifying income streams, this tool offers a comprehensive approach to recession-proofing one’s financial life.

Ultimately, the Recession Repellent is more than just a tool – it’s a lifeline for financial well-being. By utilizing its features and implementing its strategies, individuals can protect their assets, safeguard their financial future, and gain peace of mind. In a world as unpredictable as ours, having the Recession Repellent on your side is a game-changer for long-term financial success.

How to use the Recession Repellent

Financial stability is a top priority for many people, especially during times of economic uncertainty. The Recession Repellent is a powerful tool that can help individuals empower themselves and navigate through challenging economic times. By following a few key steps, you can ensure your financial stability and successfully survive any recession that may come your way.

First and foremost, building an emergency fund is critical. This fund should ideally cover at least six months of your living expenses. By setting aside a portion of your income regularly, you can establish a safety net that will provide a financial cushion during difficult times. This fund will not only help you cover essential expenses, but it will also alleviate stress and allow you to focus on finding alternative sources of income if necessary.

Another important aspect of using the Recession Repellent is assessing your expenses. Take a close look at your budget and identify areas where you can cut back. Prioritize your spending and focus on essential items while eliminating unnecessary expenses. By doing so, you can stretch your funds further and ensure that you have enough for essential needs even during a recession.

Lastly, diversify your income sources. Relying solely on one income stream can be risky, especially during a recession. Explore different ways to generate additional income, such as freelancing, starting a side business, or investing in passive income opportunities. By diversifying your income, you can increase your financial stability and better withstand any economic downturn.

In conclusion, the Recession Repellent offers a comprehensive approach to empower financial stability and survive recessions. By building an emergency fund, assessing your expenses, and diversifying your income streams, you can significantly increase your financial resilience. Take control of your financial future and implement these strategies to safeguard yourself from recessions and ensure a brighter financial outcome.

Final thoughts on the Recession Repellent: Simple Steps to Empower Financial Stability

In these uncertain times, it has become more important than ever to take control of our financial well-being. The impact of the recent recession has been felt by individuals and families around the world, leaving many feeling overwhelmed and vulnerable. However, there are simple steps that we can all take to empower our financial stability and ensure our survival during any future economic downturn.

First and foremost, it is crucial to develop a budget and stick to it. Understanding our income and expenses allows us to make informed decisions, prioritize our spending, and identify areas where we can cut back. By taking control of our finances in this way, we can create a solid foundation that will protect us in times of financial instability.

Secondly, it is important to diversify our sources of income. Relying solely on one job or one source of income leaves us vulnerable to unexpected job loss or economic downturns. Exploring additional income streams, such as freelancing or investing, can provide a safety net and increase our overall financial stability.

Lastly, building an emergency fund is essential. Setting aside a portion of our income for unexpected expenses ensures that we are prepared for any unforeseen financial challenges that may arise. This provides us with peace of mind knowing that we have a safety net to fall back on during difficult times.

In conclusion, empowering our financial stability and surviving a recession requires taking proactive steps. By creating a budget, diversifying our sources of income, and building an emergency fund, we can navigate economic uncertainties with confidence and security. These simple yet powerful strategies will empower us to overcome financial setbacks and thrive in the face of adversity.

“As an Amazon Associate I earn from qualifying purchases.”

[…] By diversifying your income sources both within and outside your current job, you can ensure greater financial security and resilience. Whether it’s a side hustle that aligns with your passions or strategic career moves within your industry, embracing multiple income streams is an essential step towards recession-proofing your finances. […]