“As an Amazon Associate I earn from qualifying purchases.”

In today’s fast-paced world, managing our finances has become more important than ever. With countless expenses, bills, and investments to keep track of, it can often feel overwhelming to stay organized and in control of our financial lives. Thankfully, there is a solution – the best financial planning organizer and expense tracker.

This innovative tool has revolutionized the way we manage our money, making it easier than ever to stay on top of our expenses and plan for the future. In this article, we will explore the top financial planning organizers and expense trackers on the market, helping you find the perfect tool to take control of your financial journey.

Whether you’re a budget-conscious individual, a small business owner, or someone looking to better understand and manage their finances, these tools will undoubtedly be your perfect companion on the path to financial success. So let’s dive in and discover the best financial planning organizers and expense trackers available today, and take a step towards achieving your financial goals!

Best Budget Planner for Achieving Financial Goals

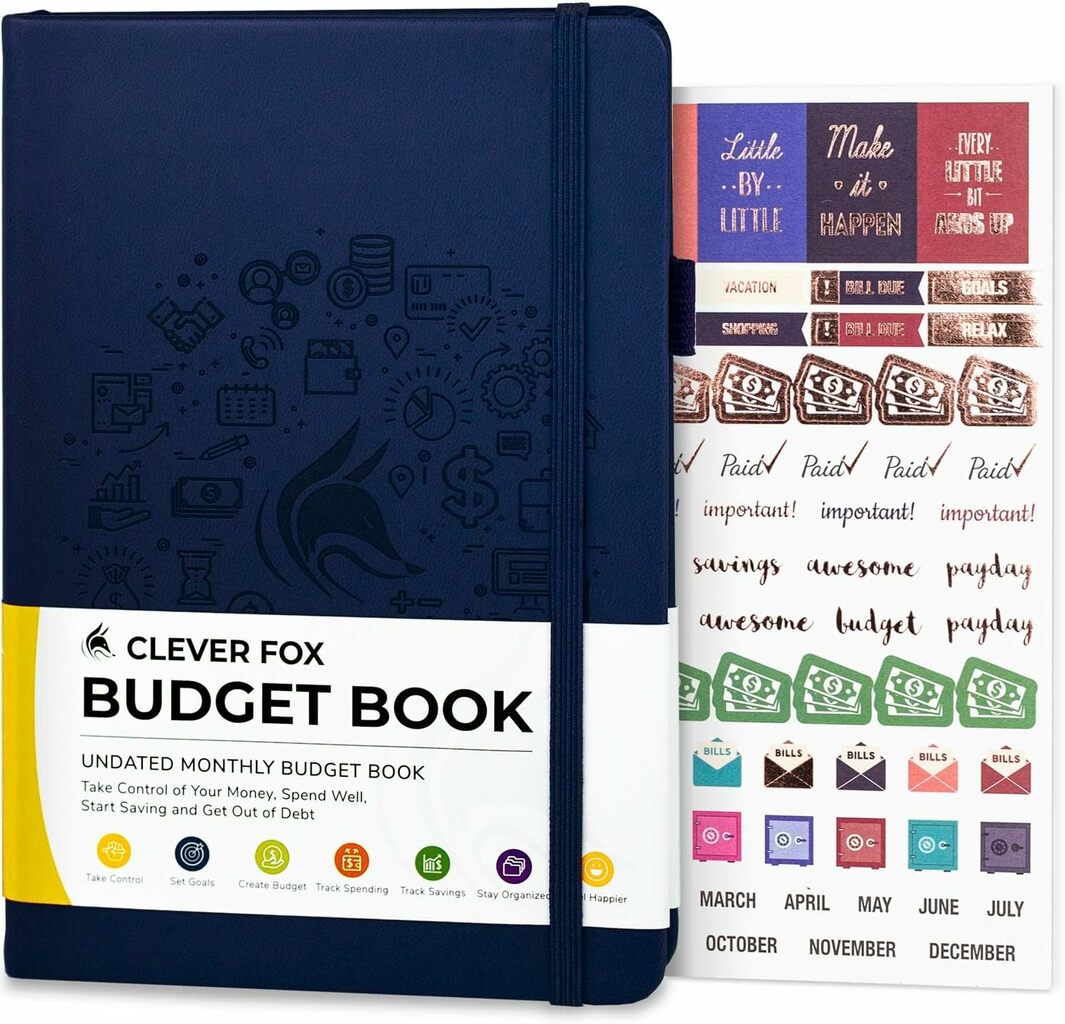

The Clever Fox Budget Book is an incredibly useful tool for anyone looking to take control of their finances. With its compact size and dark blue cover, it is not only stylish but also highly functional. The planner organizer and expense tracker make it easy to set up and maintain a monthly budget. The account notebook allows you to keep track of your income and expenses, ensuring you stay on track financially. This product from the Clever Fox Store is a must-have for anyone who wants to achieve their financial goals.

Helps you plan for the future

Great for customization

Free sheet of stickers to help with personalization

Includes user guide, stickers, and an elastic pen loop

Customizable cover page

Target: Adult

Material: Paper

Weight: 9.6 ounces

Size: 5.3″ x 7.7″

Brand: Clever Fox

Usage: Monthly Budgeting

Cover: Faux Leather

Best budgeting planner overall

Clever Fox Monthly Finance Journal

The Clever Fox Budget Planner Pro is truly a game-changer when it comes to managing one’s finances. This innovative product offers a comprehensive system for tracking expenses and staying on top of personal finances. The monthly finance journal and expense tracker provide a clear overview of income and expenses, helping users identify spending patterns and make necessary adjustments.

The inclusion of a cash envelope budget system adds an extra level of organization, ensuring that money is allocated according to specific categories. With its undated pages, users can start using the planner at any time, making it a versatile and adaptable tool. The 7”x10” size and dark green color are both aesthetically pleasing and practical. Overall, the Clever Fox Budget Planner Pro is a must-have for anyone looking to take control of their finances.

Comes with cash envelope system, stickers, and other extras

Includes comprehensive user guide and video tutorial

Comes with cash envelopes and stickers to identify them

Comes with 5 large reusable envelopes and a pocket for storing them

Comes with cash envelope system and stickers

Binding: Unknown

Brand: Clever Fox

Size: Smaller than A4 (7×10”)

Weight: 1.32 pounds

Goal of usage: Set & Achieve Big Financial Goals

Format: Organizer

Best goal-setting planner

Legend Planner Weekly & Monthly

The Legend Planner is the perfect tool for individuals looking to stay organized and reach their goals. This weekly and monthly life planner, in a beautiful wine red color, offers a comprehensive layout to help users effectively plan and manage their schedules. With its A5 size, it’s compact yet spacious enough to hold all your important notes and reminders.

The organizer notebook features dedicated sections for goal-setting, to-do lists, habit tracking, and more, ensuring you stay on track with your objectives. It also includes inspirational quotes and a gratitude journal to promote a positive mindset. The productivity journal is designed to help you prioritize tasks, increase productivity, and achieve a fulfilling work-life balance.

The Legend Planner is made with high-quality materials, combining durability with elegance. Whether you’re a professional, student, or someone simply seeking a better way to manage their time, this planner is a fantastic investment. It’s no wonder why the Legend Planner has garnered positive reviews from satisfied customers.

Stickers and user guide included

Comes with video tutorials, user guide, and more

Lots of stickers and planner accessories included

Helpful user guide

Stickers, pen holder, and pocket in back cover

Color: Wine Red Gold

Size: A5

Goal: Stay focused and productive

Usage: Weekly

Binding: Unknown

Format: Organizer

Sheet: 2020

What is the best financial planning organizer?

When it comes to managing our finances, having an effective system in place is essential. With so many options available, it can be overwhelming to choose the best financial planning organizer. However, one tool that stands out is the Financial Planner Organizer & Expense Tracker.

This innovative organizer provides a comprehensive solution for monitoring and optimizing our finances. With its user-friendly interface, it allows us to track our income, expenses, and savings effortlessly. It even provides insightful visualizations that help us understand our spending patterns and identify areas where we can cut back or save more.

One of the key features of this financial planner organizer is its expense tracking capability. It allows us to record and categorize all our expenses, making it easy to see where our money is going. Whether it’s groceries, bills, or entertainment, we can have an accurate overview of our spending habits at a glance.

Moreover, the Financial Planner Organizer & Expense Tracker also enables us to set savings goals. By entering our desired savings amount and the time frame, it helps us create a plan to achieve our financial objectives. This feature not only keeps us motivated but also ensures that we stay on track with our savings plan.

In conclusion, when it comes to managing our finances effectively, the Financial Planner Organizer & Expense Tracker is an excellent choice. Its comprehensive features, user-friendly interface, and ability to track expenses and set savings goals make it an invaluable tool for financial planning. So why not give it a try and take control of your financial future today?

Is it important to track expenses while using a financial planning organizer or budget binder?

In today’s fast-paced world, managing finances can be a challenging task. With various expenses popping up left and right, it is crucial to stay organized and keep track of where your hard-earned money is being spent. This is where a financial planning organizer or budget binder comes in handy. These tools offer a systematic approach to managing finances, and one key feature they provide is an expense tracker.

Tracking expenses is essential for several reasons. Firstly, it gives you a clear picture of your spending habits. By recording your expenses diligently, you can identify areas where you may be overspending or areas where you can cut back. This self-awareness is crucial for effective financial planning and achieving your financial goals.

Moreover, a financial planning organizer or budget binder with an expense tracker allows you to evaluate and analyze your spending patterns over time. You can monitor your monthly, quarterly, or yearly expenses and identify any trends or patterns in your spending. This information is invaluable as it helps you make informed decisions, adjust your budget, and prioritize your financial goals accordingly.

Furthermore, tracking expenses utilizing a financial planner organizer or expense tracker helps you stay accountable. It’s easy to lose track of small expenses or forget about recurring payments, which can impact your budget significantly. By regularly inputting your expenses into an organizer or tracker, you stay on top of your finances, avoid overspending, and ensure you have enough funds allocated for essential expenses.

In conclusion, it is undeniably important to track expenses while using a financial planning organizer or budget binder. Not only does it bring clarity and self-awareness to your spending habits, but it also allows you to assess your financial standing and make informed decisions. So, if you want to gain control over your finances and achieve your financial goals, consider utilizing a financial planning organizer with an expense tracker to stay on top of your expenses and ultimately secure your financial future.

What are some other inclusions that might come with a financial planning organizer or expense tracker?

When it comes to managing our finances, having the right tools can make all the difference. One such tool that can greatly assist in this process is a financial planner organizer and expense tracker. These tools have become increasingly popular in recent years, as more and more people seek to take control of their money and plan for a secure future.

While the primary purpose of a financial planner organizer and expense tracker is to help users keep track of their income and expenses, they often come with a range of other useful inclusions. One such inclusion is a budgeting feature. This allows users to set financial goals and track their progress towards achieving them. It can be incredibly helpful in identifying areas where spending can be reduced or diverted to savings.

Another useful inclusion that is commonly found in financial planner organizers and expense trackers is a bill payment reminder. This feature allows users to set reminders for upcoming bills, helping to avoid late payments and potential fees. By staying on top of bill payments, users can reduce financial stress and ensure that their credit score remains in good standing.

Some financial planner organizers and expense trackers also come with investment tracking capabilities. This allows users to monitor the performance of their investments, making it easier to make informed decisions about their portfolio. With this inclusion, users can easily see how their investments are performing, track dividends and capital gains, and make adjustments as needed.

In conclusion, a financial planner organizer and expense tracker can be a game-changer for those looking to take control of their finances. Along with helping users track their income and expenses, these tools often come with budgeting features, bill payment reminders, and investment tracking capabilities. By using a comprehensive financial planner organizer and expense tracker, individuals can gain a clearer picture of their financial health and make more informed decisions about their money.

How do you create a financial plan?

Creating a financial plan is essential for long-term financial success and stability. It provides a roadmap that helps individuals keep track of their income, expenses, and savings goals. With the right tools and strategies, anyone can create an effective financial plan. One useful tool that can assist in this process is a Financial Planner Organizer & Expense Tracker.

To begin creating a financial plan, start by assessing your current financial situation. This involves gathering important documents such as bank statements, pay stubs, and bills. By understanding your income and expenses, you can better identify areas where you can cut back or save.

Next, set clear financial goals. Whether it’s saving for a down payment on a house, paying off debt, or planning for retirement, having a specific goal in mind will help you stay motivated and focused. Use a Financial Planner Organizer & Expense Tracker to set achievable targets and track your progress regularly.

Another important aspect of creating a financial plan is creating a budget. This involves allocating your income towards different categories such as housing, transportation, groceries, and entertainment. A Financial Planner Organizer & Expense Tracker can help you track your spending and identify areas where you may be overspending.

Lastly, it’s important to regularly review and update your financial plan. Life circumstances and financial goals can change over time, so it’s crucial to adapt your plan accordingly. A Financial Planner Organizer & Expense Tracker can help you stay organized and ensure that you’re on track to achieve your financial goals.

In conclusion, creating a financial plan is crucial for managing your money effectively and achieving long-term financial goals. A Financial Planner Organizer & Expense Tracker can be a valuable tool in this process, helping you assess your current financial situation, set clear goals, create a budget, and track your progress. By taking the time to create and maintain a financial plan, you can take control of your finances and build a secure financial future.

What does a financial advisor do?

When it comes to managing our finances, many of us can feel overwhelmed and unsure of where to begin. This is where a financial advisor can play a crucial role. So, what exactly does a financial advisor do?

First and foremost, a financial advisor acts as a guide, helping individuals and families navigate the complex world of personal finance. They have extensive knowledge in areas such as investments, retirement planning, taxes, and insurance. By assessing their clients’ financial goals and objectives, a financial advisor can create personalized strategies to help them achieve these goals.

One important aspect of a financial advisor’s role is to act as a financial planner, organizer, and expense tracker. They help clients establish a budget, track their spending, and identify areas where savings can be made. By doing this, a financial advisor can help individuals develop healthy financial habits and make better financial decisions moving forward.

In addition to financial planning, a financial advisor also offers investment advice. They analyze their clients’ risk tolerance, time horizon, and financial goals to develop an investment strategy that aligns with their needs. Whether it’s building a diversified investment portfolio or maximizing returns, a financial advisor helps individuals make informed investment decisions to grow their wealth over time.

Overall, a financial advisor plays a crucial role in helping individuals and families take control of their finances and work towards their financial goals. They provide valuable advice and guidance in areas such as financial planning, budgeting, and investing. By working closely with a financial advisor, individuals can gain the confidence and knowledge they need to make sound financial decisions and secure a stable financial future.

How much does a financial advisor cost?

When it comes to managing your finances, hiring a financial advisor can provide invaluable guidance and expertise. However, many people are often deterred by the misconception that financial advisors are expensive. So, how much does a financial advisor actually cost?

The cost of a financial advisor can vary depending on various factors such as their level of experience, qualifications, and the services they offer. Typically, financial advisors charge either a fixed fee, an hourly rate, or a percentage of the assets they manage for you. In some cases, they may charge a combination of these fees depending on the complexity of your financial situation.

It’s important to note that while hiring a financial advisor does incur costs, their services can often save you money in the long run. By helping you make informed decisions, create effective financial plans, and maximize your investments, they can potentially save you from expensive mistakes and help you achieve your financial goals sooner.

If you’re hesitant about the cost of a financial advisor, there are also budget-friendly alternatives available. For instance, you can utilize technology tools such as the Financial Planner Organizer & Expense Tracker, which can assist you in managing your finances on your own. These tools often come at a fraction of the cost compared to hiring a financial advisor and can provide valuable insights into your spending habits, savings goals, and investment strategies.

Ultimately, the cost of a financial advisor should be considered an investment rather than an expense. The knowledge and assistance they provide can empower you to make sound financial decisions and navigate complex financial landscapes with confidence. Whether you choose a financial advisor or leverage technology tools, taking control of your financial future is a crucial step towards financial success.

What’s the difference between a CFA, CFP, and CPA?

When it comes to managing our finances, it’s always a good idea to seek professional help. But with so many acronyms floating around, it’s hard to know which financial expert to turn to. Three common ones you may have come across are CFA, CFP, and CPA. So, what do these acronyms mean and what’s the difference between them?

Let’s start with CFA, which stands for Chartered Financial Analyst. CFAs are experts in investment management and have extensive knowledge of financial markets, securities analysis, and portfolio management. They are often employed by investment firms, banks, or other financial institutions to provide advice on investments and help clients make informed decisions. If you’re looking for someone to help you grow your investment portfolio, a CFA could be the right choice.

On the other hand, a CFP, or Certified Financial Planner, takes a more holistic approach to financial planning. They help clients set and achieve their financial goals by providing guidance on various aspects of personal finance, including budgeting, tax planning, retirement planning, and estate planning. A CFP can act as a financial planner, organizer, and even an expense tracker. If you need help creating a comprehensive financial plan that encompasses all areas of your financial life, a CFP is the person to turn to.

Lastly, we have the CPA, or Certified Public Accountant. CPAs specialize in accounting, auditing, and tax preparation. They are licensed professionals who can provide a range of services, including financial statement preparation, tax planning, and compliance, and even forensic accounting. If you’re a small business owner or an individual with complex tax situations, a CPA can help ensure your financial records are accurate and your tax obligations are met.

In summary, the main difference between a CFA, CFP, and CPA lies in the focus of their expertise. A CFA is primarily focused on investment management, a CFP offers comprehensive financial planning, and a CPA specializes in accounting and tax-related services. Depending on your specific financial needs, you may choose to consult one or more of these professionals. Ultimately, seeking the guidance of a qualified financial expert can help you navigate the complex world of finance and make better-informed decisions for your future.

How do I hire a financial planner?

Hiring a financial planner can be a great decision for anyone who wants to gain control over their finances and make wiser financial decisions. However, choosing the right financial planner can be a daunting task. To ensure you hire someone who is qualified and trustworthy, follow these steps.

Firstly, identify your needs and goals. Before looking for a financial planner, take some time to define what you hope to achieve with their help. Whether you want assistance with retirement planning, investment management, tax planning, or simply need a financial planner organizer & expense tracker, knowing your goals will help you find the right professional who specializes in your specific needs.

Next, do your research. Look for financial planners who hold recognized credentials such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These certifications ensure that the individual has completed the necessary education and passed rigorous exams. Additionally, read reviews and testimonials from previous clients to gauge their level of satisfaction.

Once you have a list of potential financial planners, schedule interviews or consultations. This will give you an opportunity to ask questions and get a feel for their expertise and communication style. During these meetings, be sure to inquire about their fees, services offered, and any potential conflicts of interest. It’s essential to find someone who aligns with your values and puts your financial well-being first.

In conclusion, hiring a financial planner is a crucial step towards securing your financial future. By identifying your needs, conducting research, and interviewing potential candidates, you can find the right financial planner who will help you achieve your goals and provide the necessary tools like a financial planner organizer & expense tracker. Don’t rush the process, as choosing the right professional can make a significant difference in your financial success.

How can I learn to be my own financial planner?

If you want to take control of your finances and have more confidence in managing your money, learning to be your own financial planner is a great step. With the right tools and knowledge, you can effectively plan and organize your expenses, save for the future, and achieve your financial goals. One important tool that can assist you in this process is a financial planner organizer and expense tracker.

A financial planner organizer and expense tracker is a handy tool that helps you keep track of your income and expenses, create budgets, and set financial goals. It allows you to monitor your spending, identify areas where you can cut back, and make informed decisions about your finances. By regularly updating and reviewing your finances using this tool, you become more aware of your financial habits and can make adjustments accordingly.

To get started, spend some time familiarizing yourself with the financial planner organizer and expense tracker you choose. Explore its features and functionalities so that you can make the most out of it. Create a budget that aligns with your financial goals and start recording your income and expenses consistently.

Additionally, educate yourself on various personal finance topics such as budgeting, saving, investing, and debt management. There are plenty of online resources, books, and courses available that can provide you with valuable insights. Learning about financial concepts will help you make informed decisions and develop a strategy to maximize your financial well-being.

Becoming your own financial planner requires discipline, regular review of your finances, and a commitment to your financial goals. By embracing this role and utilizing a financial planner organizer and expense tracker, you can take control of your financial future and achieve financial stability and success.

“As an Amazon Associate I earn from qualifying purchases.”